Morocco"s minerals market is witnessing a nuanced shift, as indicated by the consistent increase in ores and metals imports, rising from 3. 78% of merchandise imports in 2020 to 5. 64% in 2022. This trend highlights the increasing domestic demand for minerals such as cassiterite, chalcopyrite, and chromite, creating potential opportunities for local suppliers and international traders. Despite this, ores and metals exports have remained relatively stable, accounting for approximately 5. 85% of merchandise exports in 2022, suggesting a need for strategic enhancements in export mechanisms to capitalize on global demand. The country"s import reliance juxtaposed against stable export figures may indicate a gap in local value-addition capabilities or export infrastructure. This represents a critical opportunity for businesses to invest in processing technologies or supply chain improvements that can boost export performance.

Furthermore, Morocco"s robust access to electricity—100% across all demographics—provides a solid foundation for industrial expansion in the minerals sector. Comparative global analysis suggests that Morocco could increase its market share by optimizing its production processes and aligning with international quality standards. This would not only enhance the country"s export potential but also attract foreign direct investment, particularly in untapped resources like bauxite and sphalerite. For businesses navigating this market, platforms like Aritral. com provide invaluable resources. Aritral simplifies international trade in commodities and raw materials, offering services such as product listing, direct communication, and global sales assistance. Their AI-powered marketing tools and profile management services can help firms enhance visibility and connect with key partners in Morocco"s minerals sector, ensuring competitive advantage and business growth. "

-

Najmeddin 3 ay əvvəl

Najmeddin 3 ay əvvəl Mərakeş

Satış üçün meteorit

Mərakeş

Satış üçün meteorit

Daha ətraflı məlumat üçün, xahiş edirik bizimlə şəxsi olaraq əlaqə saxlayınTəfərrüatlar

-

Anouar Hm 3 ay əvvəl

Anouar Hm 3 ay əvvəl Mərakeş

Meteor Alması

Mərakeş

Meteor Alması

Bütün növ qiymətli daşlar və meteoritlərin satışına xoş gəlmisinizTəfərrüatlar

-

Yunus Elansari 3 ay əvvəl

Yunus Elansari 3 ay əvvəl Mərakeş

Meteorit Daşları

Mərakeş

Meteorit Daşları

Müxtəlif meteoritlərTəfərrüatlar

-

Abu Jamal 3 ay əvvəl

Abu Jamal 3 ay əvvəl Mərakeş

Qiymətli daş meteor effektləri

Mərakeş

Qiymətli daş meteor effektləri

Ay meteoru nikel materialları və dəmir karbonu ehtiva edirTəfərrüatlar

-

Boujlal Taia 3 ay əvvəl

Boujlal Taia 3 ay əvvəl Mərakeş

Şergotit

Mərakeş

Şergotit

Satış üçün Dəmir Şergottit meteoritTəfərrüatlar

-

Youssef Kaddouri 3 ay əvvəl

Youssef Kaddouri 3 ay əvvəl Mərakeş

Meteorit Satıcısı

Mərakeş

Meteorit Satıcısı

Meteorit daşları satıramTəfərrüatlar

-

حجر نيزك حديدي 3 ay əvvəl

حجر نيزك حديدي 3 ay əvvəl Mərakeş

Dəmir Nizami

Mərakeş

Dəmir Nizami

\`Mərakeşdə tapılan dəmir nizami, boz parlaq və gözəl, maqnitlərə güclü cəlb olunur, ölçüsünə görə sıx, 146 qram ağırlığındaTəfərrüatlar

-

Rabi 3 ay əvvəl

Rabi 3 ay əvvəl Mərakeş

Köhnə İncəsənət Əşyalarının Satışı

Mərakeş

Köhnə İncəsənət Əşyalarının Satışı

Əl işi oyma və əl ilə çap olunmuş simvollarla bəzədilmiş qədim qablar, çox köhnə bir tarixə malikdirTəfərrüatlar

-

Obaid El Badaoui 3 ay əvvəl

Obaid El Badaoui 3 ay əvvəl Mərakeş

Qiymətli daşlar

Mərakeş

Qiymətli daşlar

Həvəskarlar və qiymətli daş sevənlər üçün cilalanmamış qırmızı jasper daşı, müsbət enerji təmin edirTəfərrüatlar

-

ابن الحسن 3 ay əvvəl

ابن الحسن 3 ay əvvəl Mərakeş

Daş

Mərakeş

Daş

DaşTəfərrüatlar

-

Mustafa 4 ay əvvəl

Mustafa 4 ay əvvəl Mərakeş

Meteorlar

Mərakeş

Meteorlar

Bu növ meteoritlər maqnitləri cəlb edir. Bu növ meteorit dəmir tərkiblidir və rüzgarda paslanma var. Dörd növ meteorit var.Təfərrüatlar

-

Hasan Wafso 3 ay əvvəl

Hasan Wafso 3 ay əvvəl Mərakeş

Qaya

Mərakeş

Qaya

Təbii oyulmuş daşTəfərrüatlar

-

Yunus Nz 3 ay əvvəl

Yunus Nz 3 ay əvvəl Mərakeş

Meteor

Mərakeş

Meteor

Mənim satışda çox sayda meteorum var, təşəkkür edirəmTəfərrüatlar

-

Əl-Əhjar 3 ay əvvəl

Əl-Əhjar 3 ay əvvəl Mərakeş

Daşlar

Mərakeş

Daşlar

Müxtəlif daşlarTəfərrüatlar

-

Kamal Go 3 ay əvvəl

Kamal Go 3 ay əvvəl Mərakeş

Meteoritlər

Mərakeş

Meteoritlər

Meteoritlər göydən düşən daşlardırTəfərrüatlar

-

Meteor 3 ay əvvəl

Meteor 3 ay əvvəl Mərakeş

Tələb

Mərakeş

Tələb

Təmizlik və aydınlıqTəfərrüatlar

-

Hamza Abu Ali 6 ay əvvəl

Hamza Abu Ali 6 ay əvvəl Mərakeş

Qiymətli daşlar

Mərakeş

Qiymətli daşlar

Mərakeş ruhani dəfnəTəfərrüatlar

-

Elkadaoui 3 ay əvvəl

Elkadaoui 3 ay əvvəl Mərakeş

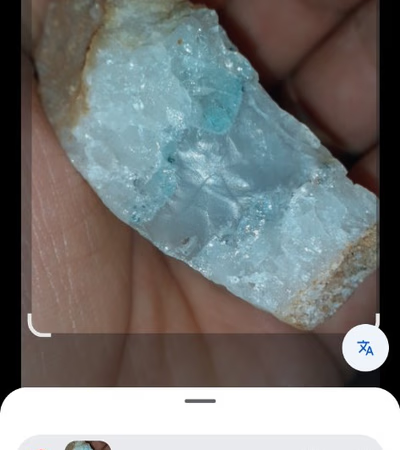

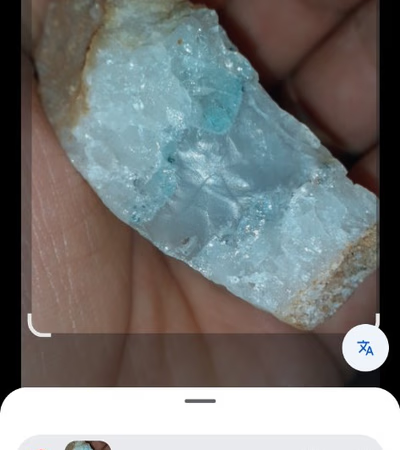

Bir daş, onun növünü bilmirəm

Mərakeş

Bir daş, onun növünü bilmirəm

Bu daşın növünü bilmirəmTəfərrüatlar

-

Abdelmottaleb Harrous 3 ay əvvəl

Abdelmottaleb Harrous 3 ay əvvəl Mərakeş

Meteorit

Mərakeş

Meteorit

Meteorit qəhvəyi rəngdədirTəfərrüatlar

-

Nizk 3 ay əvvəl

Nizk 3 ay əvvəl Mərakeş

Meteorit Daşı

Mərakeş

Meteorit Daşı

Yüksək dağlarda tapılan meteorit daşıTəfərrüatlar

-

Moumny 2 ay əvvəl

Moumny 2 ay əvvəl Mərakeş

600g Nezik

Mərakeş

600g Nezik

600g NezikTəfərrüatlar

-

Yassin 3 ay əvvəl

Yassin 3 ay əvvəl Mərakeş

Yüngül Meteorit

Mərakeş

Yüngül Meteorit

Bu, bir meteoritdir və yüngüldürTəfərrüatlar

-

Redouane 3 ay əvvəl

Redouane 3 ay əvvəl Mərakeş

Meteorit

Mərakeş

Meteorit

Meteorit və ya meteorit daşTəfərrüatlar

-

Mohssin Wadani 3 ay əvvəl

Mohssin Wadani 3 ay əvvəl Mərakeş

Daşlar

Mərakeş

Daşlar

Premium AqatTəfərrüatlar

-

Marocrystal 3 ay əvvəl

Marocrystal 3 ay əvvəl Mərakeş

Təbii Selenit Daşı

Mərakeş

Təbii Selenit Daşı

Təbii Selenit LampaTəfərrüatlar

-

Raşid 3 ay əvvəl

Raşid 3 ay əvvəl Mərakeş

Saphir Daşı

Mərakeş

Saphir Daşı

Bənövşəyi rəngdə bir daşTəfərrüatlar

-

Yasin Rais 3 ay əvvəl

Yasin Rais 3 ay əvvəl Mərakeş

Orijinal Diamond Daşı

Mərakeş

Orijinal Diamond Daşı

Nadir daş satılırTəfərrüatlar

-

Omar Makram 3 ay əvvəl

Omar Makram 3 ay əvvəl Mərakeş

Meteorit

Mərakeş

Meteorit

Qara meteorit, çəkisi 45 qramdır Maqnitelərə cəlb olunmurTəfərrüatlar

-

Boussif Mohamed 2 ay əvvəl

Boussif Mohamed 2 ay əvvəl Mərakeş

Meteorit

Mərakeş

Meteorit

Maqnitlərə cəlb olunan, çəkisi 1. 4 kiloqram olan və sıxlığı 4. 01 olan qara daş.Təfərrüatlar

-

Ali 3 ay əvvəl

Ali 3 ay əvvəl Mərakeş

Meteor

Mərakeş

Meteor

Təxminən bir kiloqram ağırlığında parlaq qara daşdır və maqnitlərə yapışırTəfərrüatlar